Page 255 - AR BRIDS 2020 - 1204 - FULL

P. 255

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2020 dan untuk As of December 31, 2020 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

15. PERPAJAKAN (lanjutan) 15. TAXATION (continued)

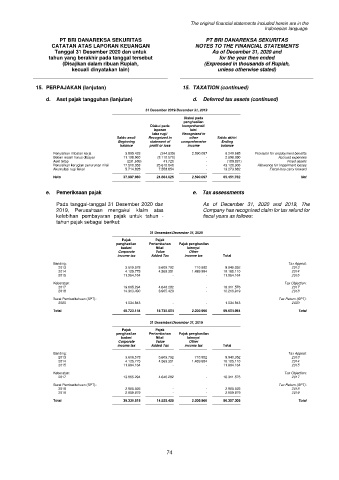

d. Aset pajak tangguhan (lanjutan) d. Deferred tax assets (continued)

31 Desember 2019/December 31, 2019

Diakui pada

penghasilan

Diakui pada komprehensif

laporan lain/

laba rugi/ Recognized in

Saldo awal/ Recognized in other Saldo akhir/

Beginning statement of comprehensive Ending

balance profit or loss income balance

Penyisihan imbalan kerja 3.895.423 (244.835) 2.590.097 6.240.685 Provision for employment benefits

Beban masih harus dibayar 11.108.960 (8.110.570) - 2.998.390 Accrued expenses

Aset tetap (231.609) 41.728 - (189.881) Fixed assets

Penyisihan kerugian penurunan nilai 17.510.058 25.618.848 - 43.128.906 Allowance for impairment losses

Akumulasi rugi fiskal 5.714.828 7.558.854 - 13.273.682 Fiscal loss carry forward

Neto 37.997.660 24.864.025 2.590.097 65.451.782 Net

e. Pemeriksaan pajak e. Tax assessments

Pada tanggal-tanggal 31 Desember 2020 dan As of December 31, 2020 and 2019, The

2019, Perusahaan mengakui klaim atas Company has recognized claim for tax refund for

kelebihan pembayaran pajak untuk tahun - fiscal years as follows:

tahun pajak sebagai berikut:

31 Desember/December 31, 2020

Pajak Pajak

penghasilan Pertambahan Pajak penghasilan

badan/ Nilai/ lainnya/

Corporate Value Other

income tax Added Tax income tax Total

Banding: Tax Appeal:

2013 3.619.578 5.609.792 710.982 9.940.352 2013

2014 4.125.775 4.569.351 1.489.984 10.185.110 2014

2015 11.964.164 - - 11.964.164 2015

Keberatan: Tax Objection:

2017 13.665.294 4.646.282 - 18.311.576 2017

2018 14.313.490 3.905.429 - 18.218.919 2018

Surat Pemberitahuan (SPT): Tax Return (SPT):

2020 1.034.843 - - 1.034.843 2020

Total 48.723.144 18.730.854 2.200.966 69.654.964 Total

31 Desember/December 31, 2019

Pajak Pajak

penghasilan Pertambahan Pajak penghasilan

badan/ Nilai/ lainnya/

Corporate Value Other

income tax Added Tax income tax Total

Banding: Tax Appeal:

2013 3.619.578 5.609.792 710.982 9.940.352 2013

2014 4.125.775 4.569.351 1.489.984 10.185.110 2014

2015 11.964.164 - - 11.964.164 2015

Keberatan: Tax Objection:

2017 13.665.294 4.646.282 - 18.311.576 2017

Surat Pemberitahuan (SPT): Tax Return (SPT):

2018 2.985.925 - - 2.985.925 2018

2019 2.969.879 - - 2.969.879 2019

Total 39.330.615 14.825.425 2.200.966 56.357.006 Total

74