Page 269 - AR BRIDS 2021 - FINAL - HIRES - 2903

P. 269

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2021 dan untuk As of December 31, 2021 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

15. PERPAJAKAN (lanjutan) 15. TAXATION (continued)

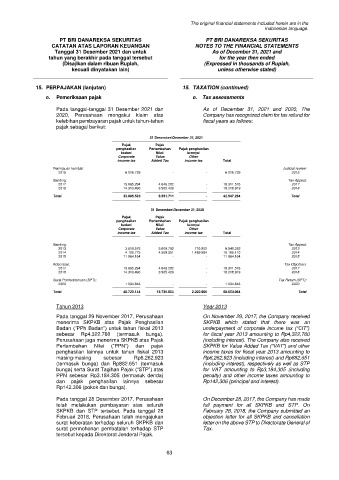

e. Pemeriksaan pajak e. Tax assessments

Pada tanggal-tanggal 31 Desember 2021 dan As of December 31, 2021 and 2020, The

2020, Perusahaan mengakui klaim atas Company has recognized claim for tax refund for

kelebihan pembayaran pajak untuk tahun-tahun fiscal years as follows:

pajak sebagai berikut:

31 Desember/December 31, 2021

Pajak Pajak

penghasilan Pertambahan Pajak penghasilan

badan/ Nilai/ lainnya/

Corporate Value Other

income tax Added Tax income tax Total

Peninjauan kembali: Judicial review:

2015 6.016.739 - - 6.016.739 2015

Banding: Tax Appeal:

2017 13.665.294 4.646.282 - 18.311.576 2017

2018 14.313.490 3.905.429 - 18.218.919 2018

Total 33.995.523 8.551.711 - 42.547.234 Total

31 Desember/December 31, 2020

Pajak Pajak

penghasilan Pertambahan Pajak penghasilan

badan/ Nilai/ lainnya/

Corporate Value Other

income tax Added Tax income tax Total

Banding: Tax Appeal:

2013 3.619.578 5.609.792 710.982 9.940.352 2013

2014 4.125.775 4.569.351 1.489.984 10.185.110 2014

2015 11.964.164 - - 11.964.164 2015

Keberatan: Tax Objection:

2017 13.665.294 4.646.282 - 18.311.576 2017

2018 14.313.490 3.905.429 - 18.218.919 2018

Surat Pemberitahuan (SPT): Tax Return (SPT):

2020 1.034.843 - - 1.034.843 2020

Total 48.723.144 18.730.854 2.200.966 69.654.964 Total

Tahun 2013 Year 2013

Pada tanggal 29 November 2017, Perusahaan On November 29, 2017, the Company received

menerima SKPKB atas Pajak Penghasilan SKPKB which stated that there was an

Badan (“PPh Badan”) untuk tahun fiskal 2013 underpayment of corporate income tax (“CIT”)

sebesar Rp4.322.760 (termasuk bunga). for fiscal year 2013 amounting to Rp4,322,760

Perusahaan juga menerima SKPKB atas Pajak (including interest). The Company also received

Pertambahan Nilai (“PPN”) dan pajak SKPKB for Value Added Tax (“VAT”) and other

penghasilan lainnya untuk tahun fiskal 2013 income taxes for fiscal year 2013 amounting to

masing-masing sebesar Rp6.262.923 Rp6,262,923 (including interest) and Rp882,651

(termasuk bunga) dan Rp882.651 (termasuk (including interest), respectively as well as STP

bunga) serta Surat Tagihan Pajak (“STP”) atas for VAT amounting to Rp3,184,305 (including

PPN sebesar Rp3.184.305 (termasuk denda) penalty) and other income taxes amounting to

dan pajak penghasilan lainnya sebesar Rp142,306 (principal and interest).

Rp142.306 (pokok dan bunga).

Pada tanggal 28 Desember 2017, Perusahaan On December 28, 2017, the Company has made

telah melakukan pembayaran atas seluruh full payment for all SKPKB and STP. On

SKPKB dan STP tersebut. Pada tanggal 28 February 28, 2018, the Company submitted an

Februari 2018, Perusahaan telah mengajukan objection letter for all SKPKB and cancellation

surat keberatan terhadap seluruh SKPKB dan letter on the above STP to Directorate General of

surat permohonan pembatalan terhadap STP Tax.

tersebut kepada Direktorat Jenderal Pajak.

63