Page 265 - AR BRIDS 2021 - FINAL - HIRES - 2903

P. 265

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2021 dan untuk As of December 31, 2021 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

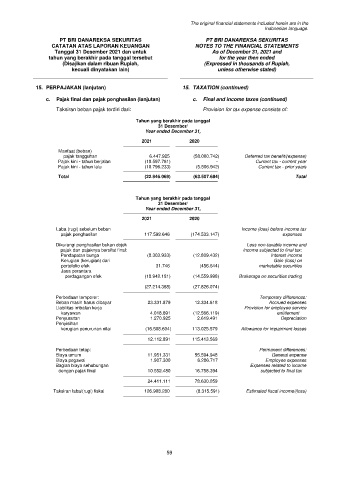

15. PERPAJAKAN (lanjutan) 15. TAXATION (continued)

c. Pajak final dan pajak penghasilan (lanjutan) c. Final and income taxes (continued)

Taksiran beban pajak terdiri dari: Provision for tax expense consists of:

Tahun yang berakhir pada tanggal

31 Desember/

Year ended December 31,

2021 2020

Manfaat (beban)

pajak tangguhan 6.447.925 (58.000.742 ) Deferred tax benefit/(expense)

Pajak kini - tahun berjalan (18.597.761) - Current tax - current year

Pajak kini - tahun lalu (10.796.233) (5.506.942 ) Current tax - prior years

Total (22.946.069) (63.507.684 ) Total

Tahun yang berakhir pada tanggal

31 Desember/

Year ended December 31,

2021 2020

Laba (rugi) sebelum beban Income (loss) before income tax

pajak penghasilan 117.598.646 (174.533.147 ) expenses

Dikurangi penghasilan bukan objek Less non-taxable income and

pajak dan pajaknya bersifat final: income subjected to final tax:

Pendapatan bunga (8.303.933) (12.809.432 ) Interest income

Kerugian (kerugian) dari Gain (loss) on

portofolio efek 31.746 (456.644 ) marketable securities

Jasa perantara

perdagangan efek (18.942.181) (14.559.998 ) Brokerage on securities trading

(27.214.368) (27.826.074 )

Perbedaan temporer: Temporary differences:

Beban masih harus dibayar 23.331.879 12.334.618 Accrued expenses

Liabilitas imbalan kerja Provision for employee service

karyawan 4.018.691 (12.566.119 ) entitlement

Penyusutan 1.270.925 2.619.491 Depreciation

Penyisihan

kerugian penurunan nilai (16.508.604) 113.025.579 Allowance for impairment losses

12.112.891 115.413.569

Perbedaan tetap: Permanent differences:

Biaya umum 11.951.331 55.594.948 General expense

Biaya pegawai 1.907.300 6.286.717 Employee expenses

Bagian biaya sehubungan Expenses related to income

dengan pajak final 10.552.480 16.758.394 subjected to final tax

24.411.111 78.630.059

Taksiran laba/(rugi) fiskal 126.908.280 (8.315.591) Estimated fiscal income/(loss)

59