Page 268 - AR BRIDS 2021 - FINAL - HIRES - 2903

P. 268

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2021 dan untuk As of December 31, 2021 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

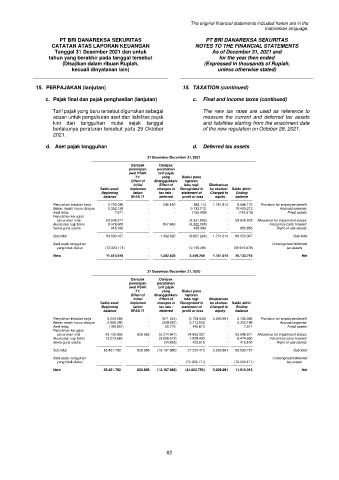

15. PERPAJAKAN (lanjutan) 15. TAXATION (continued)

c. Pajak final dan pajak penghasilan (lanjutan) c. Final and income taxes (continued)

Tarif pajak yang baru tersebut digunakan sebagai The new tax rates are used as reference to

acuan untuk pengukuran aset dan liabilitas pajak measure the current and deferred tax assets

kini dan tangguhan mulai sejak tanggal and liabilities starting from the enactment date

berlakunya peraturan tersebut yaitu 29 Oktober of the new regulation on October 29, 2021.

2021.

d. Aset pajak tangguhan d. Deferred tax assets

31 Desember/December 31, 2021

Dampak Dampak

penerapan perubahan

awal PSAK tarif pajak

71/ yang Diakui pada

Effect of ditangguhkan/ laporan

initial Effect of laba rugi/ Dibebankan

Saldo awal/ implemen changes in Recognized in ke ekuitas/ Saldo akhir/

Beginning tation tax rate - statement of Charged to Ending

balance SFAS 71 deferred profit or loss equity balance

Penyisihan imbalan kerja 5.735.086 - 545.160 884.112 1.781.814 8.946.172 Provision for employee benefit

Beban masih harus dibayar 5.352.199 - - 5.133.013 - 10.485.212 Accrued expense

Aset tetap 7.571 - - (156.089) - (148.518) Fixed assets

Penyisihan kerugian

penurunan nilai 63.548.571 - - (3.631.893) - 59.916.678 Allowance for impairment losses

Akumulasi rugi fiskal 8.474.600 - 847.460 (9.322.060) - - Fiscal loss carry forward

Sewa guna usaha 415.160 - - 435.693 - 850.853 Right-of-use-assets

Sub-total 83.533.187 - 1.392.620 (6.657.224) 1.781.814 80.050.397 Sub-total

Aset pajak tangguhan Unrecognized deferred

yang tidak diakui (72.023.171) - - 12.106.493 - (59.916.678) tax assets

Neto 11.510.016 - 1.392.620 5.449.269 1.781.814 20.133.719 Net

31 Desember/December 31, 2020

Dampak Dampak

penerapan perubahan

awal PSAK tarif pajak

71/ yang Diakui pada

Effect of ditangguhkan/ laporan

initial Effect of laba rugi/ Dibebankan

Saldo awal/ implemen changes in Recognized in ke ekuitas/ Saldo akhir/

Beginning tation tax rate - statement of Charged to Ending

balance SFAS 71 deferred profit or loss equity balance

Penyisihan imbalan kerja 6.240.685 - (971.044) (2.764.546) 3.229.991 5.735.086 Provision for employee benefit

Beban masih harus dibayar 2.998.390 - (359.807) 2.713.616 - 5.352.199 Accrued expense

Aset tetap (189.881) - 50.779 146.673 - 7.571 Fixed assets

Penyisihan kerugian

penurunan nilai 43.128.906 828.985 (5.274.947) 24.865.627 - 63.548.571 Allowance for impairment losses

Akumulasi rugi fiskal 13.273.682 - (6.628.512) 1.829.430 - 8.474.600 Fiscal loss carry forward

Sewa guna usaha - - (14.455) 429.615 - 415.160 Right-of-use-assets

Sub-total 65.451.782 828.985 (13.197.986) 27.220.415 3.229.991 83.533.187 Sub-total

Aset pajak tangguhan Unrecognized deferred

yang tidak diakui - - - (72.023.171) - (72.023.171) tax assets

Neto 65.451.782 828.985 (13.197.986) (44.802.756) 3.229.991 11.510.016 Net

62