Page 354 - AR BRIDS 2022 - EBOOK - FINAL

P. 354

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2022 dan untuk As of December 31, 2022 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

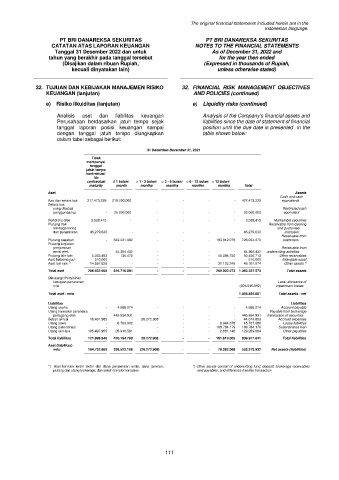

32. TUJUAN DAN KEBIJAKAN MANAJEMEN RISIKO 32. FINANCIAL RISK MANAGEMENT OBJECTIVES

KEUANGAN (lanjutan) AND POLICIES (continued)

e) Risiko likuiditas (lanjutan) e) Liquidity risks (continued)

Analisis aset dan liabilitas keuangan Analysis of the Company’s financial assets and

Perusahaan berdasarkan jatuh tempo sejak liabilities since the date of statement of financial

tanggal laporan posisi keuangan sampai position until the due date is presented in the

dengan tanggal jatuh tempo diungkapkan table shown below:

dalam tabel sebagai berikut:

31 Desember/December 31, 2021

Tidak

mempunyai

tanggal

jatuh tempo

kontraktual/

No

contractual ≤ 1 bulan/ > 1 - 3 bulan/ > 3 - 6 bulan/ > 6 - 12 bulan/ > 12 bulan/

maturity month months months months months Total

Aset Assets

Cash and cash

Kas dan setara kas 217.473.239 210.000.000 - - - - 427.473.239 equivalents

Setara kas

yang dibatasi Restricted cash

penggunaanya - 20.000.000 - - - - 20.000.000 equivalent

Portofolio efek 3.538.415 - - - - - 3.538.415 Marketable securities

Piutang dari Receivable from clearing

lembaga kliring and guarantee

dan penjaminan 45.279.630 - - - - - 45.279.630 institution

Receivable from

Piutang nasabah - 542.221.992 - - - 183.812.078 726.034.070 customers

Piutang kegiatan

penjaminan Receivable from

emisi efek - 44.364.432 - - - - 44.364.432 underwriting activities

Piutang lain-lain 5.233.493 130.470 - - - 45.086.750 50.450.713 Other receivables

Aset takberwujud 510.000 - - - - - 510.000 Intangible asset

Aset lain-lain *) 14.597.829 - - - - 31.103.245 45.701.074 Other assets *)

Total aset 286.632.606 816.716.894 - - - 260.002.073 1.363.351.573 Total assets

Dikurangi: Penyisihan

kerugian penurunan Less: allowance of

nilai (304.516.692) impairment losses

Total aset - neto 1.058.834.881 Total assets - net

Liabilitas Liabilities

Utang usaha - 4.586.274 - - - - 4.586.274 Account payable

Utang transaksi perantara Payable from brokerage

pedagang efek - 445.934.931 - - - - 445.934.931 transaction of securities

Beban akrual 16.401.985 - 28.272.908 - - - 44.674.893 Accrued expenses

Utang sewa - 6.763.002 - - - 8.944.678 15.707.680 Lease liabilities

Utang subordinasi - - - - - 169.784.179 169.784.179 Subordinated loan

Utang lain-lain 105.497.955 20.910.581 - - - 2.881.148 129.289.684 Other payables

Total liabilitas 121.899.940 478.194.788 28.272.908 - - 181.610.005 809.977.641 Total liabilities

Aset (liabilitas)

neto 164.732.666 338.522.106 (28.272.908) - - 78.392.068 553.373.932 Net assets (liabilities)

*) Aset lain-lain terdiri terdiri dari dana penjaminan emisi, dana jaminan, *) Other assets consist of underwriting fund, deposit, brokerage receivables

piutang dan utang brokerage, dan selisih transfer transaksi and payables, and difference transfer transaction

111