Page 353 - AR BRIDS 2022 - EBOOK - FINAL

P. 353

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2022 dan untuk As of December 31, 2022 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

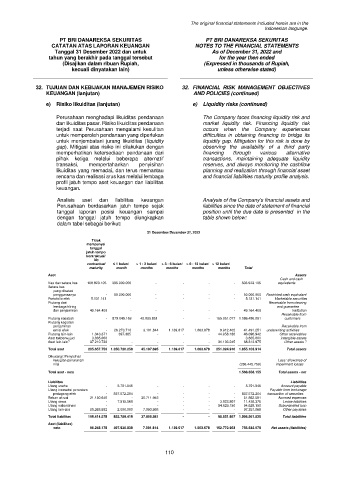

32. TUJUAN DAN KEBIJAKAN MANAJEMEN RISIKO 32. FINANCIAL RISK MANAGEMENT OBJECTIVES

KEUANGAN (lanjutan) AND POLICIES (continued)

e) Risiko likuiditas (lanjutan) e) Liquidity risks (continued)

Perusahaan menghadapi likuiditas pendanaan The Company faces financing liquidity risk and

dan likuiditas pasar. Risiko likuiditas pendanaan market liquidity risk. Financing liquidity risk

terjadi saat Perusahaan mengalami kesulitan occurs when the Company experiences

untuk memperoleh pendanaan yang diperlukan difficulties in obtaining financing to bridge its

untuk menjembatani jurang likuiditas (liquidity liquidity gap. Mitigation for this risk is done by

gap). Mitigasi atas risiko ini dilakukan dengan observing the availability of a third party

memperhatikan ketersediaan pendanaan dari financing through various alternative

pihak ketiga melalui beberapa alternatif transactions, maintaining adequate liquidity

transaksi, mempertahankan penyisihan reserves, and always monitoring the cashflow

likuiditas yang memadai, dan terus memantau planning and realization through financial asset

rencana dan realisasi arus kas melalui lembaga and financial liabilities maturity profile analysis.

profil jatuh tempo aset keuangan dan liabilitas

keuangan.

Analisis aset dan liabilitas keuangan Analysis of the Company’s financial assets and

Perusahaan berdasarkan jatuh tempo sejak liabilities since the date of statement of financial

tanggal laporan posisi keuangan sampai position until the due date is presented in the

dengan tanggal jatuh tempo diungkapkan table shown below:

dalam tabel sebagai berikut:

31 Desember/December 31, 2022

Tidak

mempunyai

tanggal

jatuh tempo

kontraktual/

No

contractual ≤ 1 bulan/ > 1 - 3 bulan/ > 3 - 6 bulan/ > 6 - 12 bulan/ > 12 bulan/

maturity month months months months months Total

Aset Assets

Cash and cash

Kas dan setara kas 108.923.105 395.000.000 - - - - 503.923.105 equivalents

Setara kas

yang dibatasi

penggunaanya - 50.000.000 - - - - 50.000.000 Restricted cash equivalent

Portofolio efek 5.131.141 - - - - - 5.131.141 Marketable securities

Piutang dari Receivable from clearing

lembaga kliring and guarantee

dan penjaminan 49.164.409 - - - - - 49.164.409 institution

Receivable from

Piutang nasabah - 879.049.163 42.095.851 - - 165.351.077 1.086.496.091 customers

Piutang kegiatan

penjaminan Receivable from

emisi efek - 26.273.710 3.101.844 1.139.617 1.063.678 9.912.402 41.491.251 underwriting activities

Piutang lain-lain 1.343.371 397.385 - - - 44.958.186 46.698.942 Other receivables

Aset takberwujud 3.885.000 - - - - - 3.885.000 Intangible assets

Aset lain-lain *) 37.210.730 - - - - 31.103.245 68.313.975 Other assets *)

Total aset 205.657.756 1.350.720.258 45.197.695 1.139.617 1.063.678 251.324.910 1.855.103.914 Total assets

Dikurangi: Penyisihan

kerugian penurunan Less: allowance of

nilai (286.445.759) impairment losses

Total aset - neto 1.568.658.155 Total assets - net

Liabilitas Liabilities

Utang usaha - 5.701.646 - - - - 5.701.646 Account payable

Utang transaksi perantara Payable from brokerage

pedagang efek - 837.572.204 - - - - 837.572.204 transaction of securities

Beban akrual 21.150.646 - 30.711.945 - - - 51.862.591 Accrued expenses

Utang sewa - 7.515.569 - - - 3.922.807 11.438.376 Lease liabilities

Utang subordinasi - - - - - 94.629.150 94.629.150 Subordinated loan

Utang lain-lain 88.263.932 2.000.000 7.093.936 - - - 97.357.868 Other payables

Total liabilitas 109.414.578 852.789.419 37.805.881 - - 98.551.957 1.098.561.835 Total liabilities

Aset (liabilitas)

neto 96.243.178 497.930.839 7.391.814 1.139.617 1.063.678 152.772.953 756.542.079 Net assets (liabilities)

110