Page 118 - AR BRIDS 2022 - EBOOK - FINAL

P. 118

PT BRI DANAREKSA SEKURITAS

Laporan Tahunan Terintegrasi 2022

Perubahan 2021-2022

Changes in 2021-2022

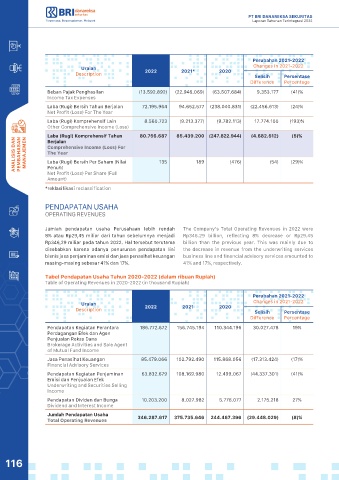

Uraian

Description 2022 2021* 2020 Selisih Persentase

Difference Percentage

Beban Pajak Penghasilan (13.592.892) (22.946.069) (63.507.684) 9.353.177 (41)%

Income Tax Expenses

Laba (Rugi) Bersih Tahun Berjalan 72.195.964 94.652.577 (238.040.831) (22.456.613) (24)%

Net Profit (Loss) For The Year

Laba (Rugi) Komprehensif Lain 8.560.723 (9.213.377) (9.782.113) 17.774.100 (193)%

Other Comprehensive Income (Loss)

Laba (Rugi) Komprehensif Tahun 80.756.687 85.439.200 (247.822.944) (4.682.512) (5)%

ANALISIS DAN PEMBAHASAN MANAJEMEN Comprehensive Income (Loss) For 135 189 (476) (54) (29)%

Berjalan

The Year

Laba (Rugi) Bersih Per Saham (Nilai

Penuh)

Net Profit (Loss) Per Share (Full

Amount)

*reklasifikasi reclassification

PENDAPATAN USAHA

OPERATING REVENUES

Jumlah pendapatan usaha Perusahaan lebih rendah The Company’s Total Operating Revenues in 2022 were

8% atau Rp29,45 miliar dari tahun sebelumnya menjadi Rp346.29 billion, reflecting 8% decrease or Rp29.45

Rp346,29 miliar pada tahun 2022. Hal tersebut terutama billion than the previous year. This was mainly due to

disebabkan karena adanya penurunan pendapatan lini the decrease in revenue from the underwriting services

bisnis jasa penjaminan emisi dan jasa penasihat keuangan business line and financial advisory services amounted to

masing-masing sebesar 41% dan 17%. 41% and 17%, respectively.

Tabel Pendapatan Usaha Tahun 2020-2022 (dalam ribuan Rupiah)

Table of Operating Revenues in 2020-2022 (in thousand Rupiah)

Perubahan 2021-2022

Uraian Changes in 2021-2022

Description 2022 2021 2020 Selisih Persentase

Difference Percentage

Pendapatan Kegiatan Perantara 186.772.672 156.745.194 110.344.196 30.027.478 19%

Perdagangan Efek dan Agen

Penjualan Reksa Dana

Brokerage Activities and Sale Agent

of Mutual Fund Income

Jasa Penasihat Keuangan 85.479.066 102.792.490 115.868.056 (17.313.424) (17)%

Financial Advisory Services

Pendapatan Kegiatan Penjaminan 63.832.679 108.169.980 12.499.067 (44.337.301) (41)%

Emisi dan Penjualan Efek

Underwriting and Securities Selling

Income

Pendapatan Dividen dan Bunga 10.203.200 8.027.982 5.776.077 2.175.218 27%

Dividend and Interest Income

Jumlah Pendapatan Usaha 346.287.617 375.735.646 244.487.396 (29.448.029) (8)%

Total Operating Revenues

116