Page 286 - AR BRIDS 2020 - 1204 - FULL

P. 286

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2020 dan untuk As of December 31, 2020 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

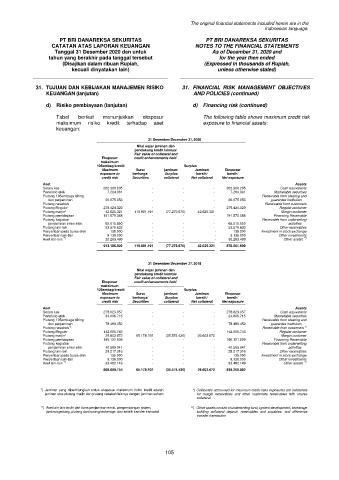

31. TUJUAN DAN KEBIJAKAN MANAJEMEN RISIKO 31. FINANCIAL RISK MANAGEMENT OBJECTIVES

KEUANGAN (lanjutan) AND POLICIES (continued)

d) Risiko pembiayaan (lanjutan) d) Financing risk (continued)

Tabel berikut menunjukkan eksposur The following table shows maximum credit risk

maksimum risiko kredit terhadap aset exposure to financial assets:

keuangan:

31 Desember/December 31, 2020

Nilai wajar jaminan dan

pendukung kredit lainnya/

Fair value of collateral and

Eksposur credit enhancements held

maksimum

105embag kredit/ Surplus

Maximum Surat jaminan/ Jaminan Eksposur

exposure to berharga/ Surplus bersih/ bersih/

credit risk Securities collateral Net collateral Net exposure

Aset Assets

Setara kas 202.300.205 - - - 202.300.205 Cash equivalents

Portofolio efek 7.264.961 - - - 7.264.961 Marketable securities

Piutang 105embaga kliring Receivable from clearing and

dan penjaminan 26.075.053 - - - 26.075.053 guarantee institution

Piutang nasabah Receivable from customers

Piutang Reguler 279.424.320 - - - 279.424.320 Regular customer

Piutang marjin ) 42.625.321 119.901.191 (77.275.870 ) 42.625.321 - Margin customer

Piutang pembiayaan 191.570.088 - - - 191.570.088 Financing Receivable

Piutang kegiatan Receivable from underwriting

penjaminan emisi efek 65.815.850 - - - 65.815.850 activities

Piutang lain-lain 53.576.633 - - - 53.576.633 Other receivables

Penyertaan pada bursa efek 135.000 - - - 135.000 Investment in stock exchange

Penyertaan lain-lain 9.136.000 - - - 9.136.000 Other investments

Aset lain-lain **) 35.263.489 - - - 35.263.489 Other assets

**)

913.186.920 119.901.191 (77.275.870) 42.625.321 870.561.599

31 Desember/December 31, 2019

Nilai wajar jaminan dan

pendukung kredit lainnya/

Fair value of collateral and

Eksposur credit enhancements held

maksimum

105embag kredit/ Surplus

Maximum Surat jaminan/ Jaminan Eksposur

exposure to berharga/ Surplus bersih/ bersih/

credit risk Securities collateral Net collateral Net exposure

Aset Assets

Setara kas 278.023.057 - - - 278.023.057 Cash equivalents

Portofolio efek 34.006.715 - - - 34.006.715 Marketable securities

Piutang 105embaga kliring Receivable from clearing and

dan penjaminan 78.489.452 - - - 78.489.452 guarantee institution

*)

Piutang nasabah *) Receivable from customers

Piutang Reguler 142.005.743 - - - 142.005.743 Regular customer

Piutang marjin ) 29.603.672 65.178.102 (35.574.430 ) 29.603.672 - Margin customer

Piutang pembiayaan 195.121.609 - - - 195.121.609 Financing Receivable

Piutang kegiatan Receivable from underwriting

penjaminan emisi efek 40.589.041 - - - 40.589.041 activities

Piutang lain-lain 28.217.316 - - - 28.217.316 Other receivables

Penyertaan pada bursa efek 135.000 - - - 135.000 Investment in stock exchange

Penyertaan lain-lain 9.136.000 - - - 9.136.000 Other investments

**)

Aset lain-lain **) 33.482.149 - - - 33.482.149 Other assets

868.809.754 65.178.102 (35.574.430) 29.603.672 839.206.082

*) Jaminan yang diperhitungkan untuk eksposur maksimum risiko kredit adalah *) Collaterals accounted for maximum credit risks exposures are collaterals

jaminan atas piutang marjin dan piutang nasabah lainnya dengan jaminan saham for margin receivables and other customers receivables with shares

collateral

**) Aset lain-lain terdiri dari dana penjaminan emisi, pengembangan sistem, **) Other assets consist of underwriting fund, system development, brokerage

jaminan gedung, piutang dan hutang brokerage, dan selisih transfer transaksi building collateral deposit, receivables and payables, and difference

transfer transaction

105