Page 283 - AR BRIDS 2020 - 1204 - FULL

P. 283

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2020 dan untuk As of December 31, 2020 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

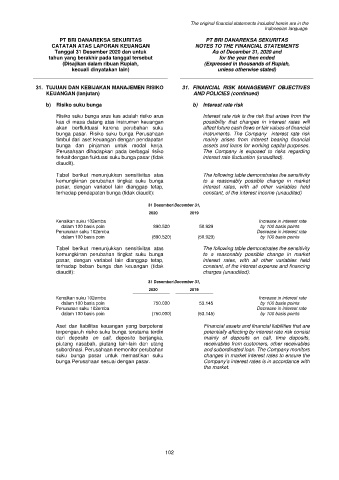

31. TUJUAN DAN KEBIJAKAN MANAJEMEN RISIKO 31. FINANCIAL RISK MANAGEMENT OBJECTIVES

KEUANGAN (lanjutan) AND POLICIES (continued)

b) Risiko suku bunga b) Interest rate risk

Risiko suku bunga arus kas adalah risiko arus Interest rate risk is the risk that arises from the

kas di masa datang atas instrumen keuangan possibility that changes in interest rates will

akan berfluktuasi karena perubahan suku affect future cash flows or fair values of financial

bunga pasar. Risiko suku bunga Perusahaan instruments. The Company interest rate risk

timbul dari aset keuangan dengan pendapatan mainly arises from interest bearing financial

bunga dan pinjaman untuk modal kerja. assets and loans for working capital purposes.

Perusahaan dihadapkan pada berbagai risiko The Company is exposed to risks regarding

terkait dengan fluktuasi suku bunga pasar (tidak interest rate fluctuation (unaudited).

diaudit).

Tabel berikut menunjukkan sensitivitas atas The following table demonstrates the sensitivity

kemungkinan perubahan tingkat suku bunga to a reasonably possible change in market

pasar, dengan variabel lain dianggap tetap, interest rates, with all other variables held

terhadap pendapatan bunga (tidak diaudit): constant, of the interest income (unaudited)

31 Desember/December 31,

2020 2019

Kenaikan suku 102emba Increase in interest rate

dalam 100 basis poin 890.520 50.929 by 100 basis points

Penurunan suku 102emba Decrease in interest rate

dalam 100 basis poin (890.520) (50.929) by 100 basis points

Tabel berikut menunjukkan sensitivitas atas The following table demonstrates the sensitivity

kemungkinan perubahan tingkat suku bunga to a reasonably possible change in market

pasar, dengan variabel lain dianggap tetap, interest rates, with all other variables held

terhadap beban bunga dan keuangan (tidak constant, of the interest expense and financing

diaudit): charges (unaudited):

31 Desember/December 31,

2020 2019

Kenaikan suku 102emba Increase in interest rate

dalam 100 basis poin 750.000 53.145 by 100 basis points

Penurunan suku 102emba Decrease in interest rate

dalam 100 basis poin (750.000) (53.145) by 100 basis points

Aset dan liabilitas keuangan yang berpotensi Financial assets and financial liabilities that are

terpengaruh risiko suku bunga terutama terdiri potentially affecting by interest rate risk consist

dari deposito on call, deposito berjangka, mainly of deposits on call, time deposits,

piutang nasabah, piutang lain-lain dan utang receivables from customers, other receivables

subordinasi. Perusahaan memonitor perubahan and subordinated loan. The Company monitors

suku bunga pasar untuk memastikan suku changes in market interest rates to ensure the

bunga Perusahaan sesuai dengan pasar. Company’s interest rates is in accordance with

the market.

102