Page 383 - BRIDS IAR 2023_hires

P. 383

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

32. TUJUAN DAN KEBIJAKAN MANAJEMEN RISIKO 32. FINANCIAL RISK MANAGEMENT OBJECTIVES

KEUANGAN (lanjutan) AND POLICIES (continued)

d) Risiko pembiayaan (lanjutan) d) Financing risk (continued)

Eksposur risiko pembiayaan Perusahaan The Company’s exposure to financing risks

berkaitan dengan kegiatan broker saham related to its activities as a stock broker is

terasosiasi pada posisi kontraktual nasabah associated with customer’s contractual position

yang muncul pada saat perdagangan. Mitigasi that appears during the trade. The main

utama risiko pembiayaan tersebut adalah mitigation for financing risk is through

melalui evaluasi nasabah, penerapan limit customer’s evaluations, transaction limit

transaksi, serta penyediaan jaminan oleh application, as well as the provision of

nasabah dan pengelolaan jaminan dengan guarantees/collaterals by the customer and the

memperhatikan likuiditas, volatilitas, dan management of guarantees in respect of

kecukupan nilai jaminan. Jenis instrumen yang liquidity, volatility, and the adequacy of the

diterima Perusahaan sebagai jaminan dapat collateral value. Types of instruments

berupa kas dan efek yang tercatat di bursa. acceptable by the Company as collateral can

Disiplin dalam pengelolaan kecukupan jaminan be cash and securities listed on the stock

melalui mekanisme permintaan top up atau exchange. Being disciplined in the

force sell merupakan faktor penting untuk management of the adequacy of collateral

menjaga kualitas pembiayaan yang diberikan through request for top up or force sell is an

kepada nasabah. Perusahaan mempunyai important factor to maintain the quality of the

eksposur terhadap piutang yang telah jatuh financing provided to customers. The Company

tempo dan Perusahaan telah menurunkan has exposure to overdue receivables and the

nilainya ke estimasi jumlah terpulihkan. Atas Company has reduced its value to the

piutang tersebut, Perusahaan telah menerima estimated recoverable amount. The Company

jaminan yang memadai. has received sufficient guarantee for that

receivable.

Di samping itu, kebijakan limit ditetapkan untuk In addition, the establishment of limits policy is

memastikan aktivitas pembiayaan Perusahaan to ensure the Company’s financing activities

dilakukan secara hati-hati dengan membatasi are carefully implemented by limiting the risk to

tingkat risiko sampai batas yang dapat ditolerir the extent that can be tolerated by the Company

oleh Perusahaan sehingga potensi kerugian so that the potential financial risk losses can still

risiko pembiayaan yang timbul masih dapat be absorbed by the Company’s capital that has

diserap dengan modal Perusahaan yang telah been allocated. The Company has set financing

dialokasikan. Perusahaan telah melakukan limits and regularly monitors the financial risk

penetapan limit pembiayaan dan secara rutin exposure in their portofolios, business

melakukan pemantauan atas eksposur risiko segments and economic sectors.

pembiayaan secara portofolio, segmen bisnis,

dan sektor ekonomi.

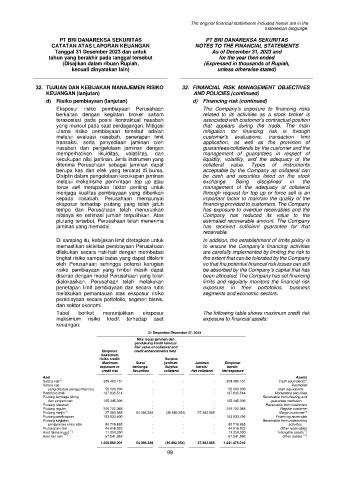

Tabel berikut menunjukkan eksposur The following table shows maximum credit risk

maksimum risiko kredit terhadap aset exposure to financial assets:

keuangan:

31 Desember/December 31, 2023

Nilai wajar jaminan dan

pendukung kredit lainnya/

Fair value of collateral and

Eksposur credit enhancements held

maksimum

risiko kredit/ Surplus

Maximum Surat jaminan/ Jaminan Eksposur

exposure to berharga/ Surplus bersih/ bersih/

credit risk Securities collateral Net collateral Net exposure

Aset Assets

Setara kas* ) 309.480.151 - - - 309.480.151 Cash equivalents* )

Setara kas Restricted

yang dibatasi penggunaannya 50.000.000 - - - 50.000.000 cash equivalents

Portofolio efek 167.835.514 - - - 167.835.514 Marketable securities

Piutang lembaga kliring Receivable from clearing and

dan penjaminan 105.445.306 - - - 105.445.306 guarantee institution

Piutang nasabah - - - - - Receivable from customers

Piutang reguler 240.752.368 - - - 240.752.368 Regular customer

Piutang marjin **) 27.383.985 64.366.339 (36.982.354) 27.383.985 - Margin customer **)

Piutang pembiayaan 163.833.406 - - - 163.833.406 Financing receivable

Piutang kegiatan Receivable from underwriting

penjaminan emisi efek 80.718.885 - - - 80.718.885 activities

Piutang lain-lain 44.618.523 - - - 44.618.523 Other receivables

Aset takberwujud ***) 11.250.000 - - - 11.250.000 Intangible assets ***)

Aset lain-lain ****) 67.541.863 - - - 67.541.863 Other assets ****)

1.268.860.001 64.366.339 (36.982.354) 27.383.985 1.241.476.016

99