Page 128 - BRIDS IAR 2023_hires

P. 128

Analisis dan Pembahasan Manajemen

Management Discussion and Analysis

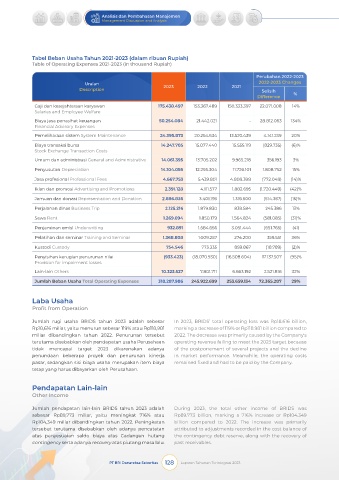

Tabel Beban Usaha Tahun 2021-2023 (dalam ribuan Rupiah)

Table of Operating Expenses 2021-2023 (in thousand Rupiah)

Perubahan 2022-2023

Uraian 2022-2023 Changes

Description 2023 2022 2021 Selisih

Difference %

Gaji dan kesejahteraan karyawan 175.438.497 153.367.489 150.333.397 22.071.008 14%

Salaries and Employee Welfare

Biaya jasa penasihat keuangan 50.254.084 21.442.021 - 28.812.063 134%

Financial Advisory Expenses

Pemeliharaan sistem System Maintenance 24.395.873 20.254.634 13.520.439 4.141.239 20%

Biaya transaksi bursa 14.247.705 15.077.440 15.555.119 (829.735) (6)%

Stock Exchange Transaction Costs

Umum dan administrasi General and Administrative 14.061.395 13.705.202 9.965.218 356.193 3%

Penyusutan Depreciation 14.104.056 12.295.304 11.726.101 1.808.752 15%

Jasa profesional Professional Fees 4.667.753 5.439.801 4.808.398 (772.048) (14)%

Iklan dan promosi Advertising and Promotions 2.391.128 4.111.577 1.882.695 (1.720.449) (42)%

Jamuan dan donasi Representation and Donation 2.886.836 3.401.193 1.318.500 (514.357) (15)%

Perjalanan dinas Business Trip 2.125.216 1.879.830 839.584 245.386 13%

Sewa Rent 1.269.094 1.850.179 1.564.824 (581.085) (31)%

Penjaminan emisi Underwriting 932.891 1.584.656 3.051.444 (651.765) (41)

Pelatihan dan seminar Training and Seminar 1.368.808 1.009.257 274.200 359.551 36%

Kustodi Custody 754.546 773.335 859.867 (18.789) (2)%

Penyisihan kerugian penurunan nilai (933.423) (18.070.930) (16.508.604) 17.137.507 (95)%

Provision for impairment losses

Lain-lain Others 10.323.527 7.801.711 6.663.192 2.521.816 32%

Jumlah Beban Usaha Total Operating Expenses 318.287.986 245.922.699 253.659.134 72.365.287 29%

Laba Usaha

Profit from Operation

Jumlah rugi usaha BRIDS tahun 2023 adalah sebesar In 2023, BRIDS’ total operating loss was Rp18.616 billion,

Rp18,616 miliar, yaitu menurun sebesar 119% atau Rp118,981 marking a decrease of 119% or Rp118.981 billion compared to

miliar dibandingkan tahun 2022. Penurunan tersebut 2022. The decrease was primarily caused by the Company's

terutama disebabkan oleh pendapatan usaha Perusahaan operating revenue failing to meet the 2023 target because

tidak mencapai target 2023 dikarenakan adanya of the postponement of several projects and the decline

penundaan beberapa proyek dan penurunan kinerja in market performance. Meanwhile, the operating costs

pasar, sedangkan sisi biaya usaha merupakan item biaya remained fixed and had to be paid by the Company.

tetap yang harus dibayarkan oleh Perusahaan.

Pendapatan Lain-lain

Other Income

Jumlah pendapatan lain-lain BRIDS tahun 2023 adalah During 2023, the total other income of BRIDS was

sebesar Rp89,773 miliar, yaitu meningkat 716% atau Rp89.773 billion, marking a 716% increase or Rp104.349

Rp104,349 miliar dibandingkan tahun 2022. Peningkatan billion compared to 2022. The increase was primarily

tersebut terutama disebabkan oleh adanya pencatatan attributed to adjustments recorded in the cost balance of

atas penyesuaian saldo biaya atas Cadangan hutang the contingency debt reserve, along with the recovery of

contingency serta adanya recovery atas piutang masa lalu. past receivables.

PT BRI Danareksa Sekuritas 128 Laporan Tahunan Terintegrasi 2023