Page 303 - AR BRIDS 2022 - EBOOK - FINAL

P. 303

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2022 dan untuk As of December 31, 2022 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

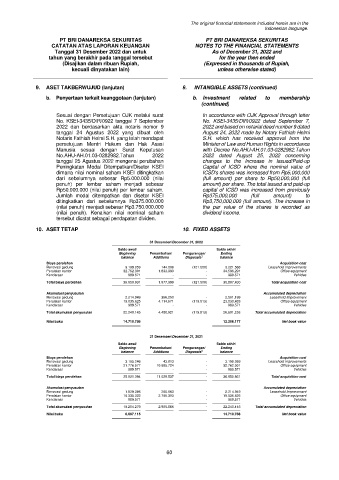

9. ASET TAKBERWUJUD (lanjutan) 9. INTANGIBLE ASSETS (continued)

b. Penyertaan terkait keanggotaan (lanjutan) b. Investment related to membership

(continued)

Sesuai dengan Persetujuan OJK melalui surat In accordance with OJK Approval through letter

No. KSEI-3435/DIR/0922 tanggal 7 September No. KSEI-3435/DIR/0922 dated September 7,

2022 dan berdasarkan akta notaris nomor 9 2022 and based on notarial deed number 9 dated

tanggal 24 Agustus 2022 yang dibuat oleh August 24, 2022 made by Notary Fathiah Helmi

Notaris Fathiah Helmi S.H. yang telah mendapat S.H. which has received approval from the

persetujuan Mentri Hukum dan Hak Asasi Minister of Law and Human Rights in accordance

Manusia sesuai dengan Surat Keputusan with Decree No.AHU-AH.01.03-0282982.Tahun

No.AHU-AH.01.03-0282982.Tahun 2022 2022 dated August 25, 2022 concerning

tanggal 25 Agustus 2022 mengenai perubahan changes to the Increase in Issued/Paid-up

Peningkatan Modal Ditempatkan/Disetor KSEI Capital of ICSD where the nominal value of

dimana nilai nominal saham KSEI ditingkatkan ICSD's shares was increased from Rp5,000,000

dari sebelumnya sebesar Rp5.000.000 (nilai (full amount) per share to Rp50,000,000 (full

penuh) per lembar saham menjadi sebesar amount) per share. The total issued and paid-up

Rp50.000.000 (nilai penuh) per lembar saham. capital of ICSD was increased from previously

Jumlah modal ditempatkan dan disetor KSEI Rp375,000,000 (full amount) to

ditingkatkan dari sebelumnya Rp375.000.000 Rp3,750,000,000 (full amount). The increase in

(nilai penuh) menjadi sebesar Rp3.750.000.000 the par value of the shares is recorded as

(nilai penuh). Kenaikan nilai nominal saham dividend income.

tersebut dicatat sebagai pendapatan dividen.

10. ASET TETAP 10. FIXED ASSETS

31 Desember/December 31, 2022

Saldo awal/ Saldo akhir/

Beginning Penambahan/ Pengurangan/ Ending

balance Additions Disposals *) balance

Biaya perolehan Acquisition cost

Renovasi gedung 3.199.059 144.009 (121.500) 3.221.568 Leasehold improvements

Peralatan kantor 32.762.301 1.833.990 - 34.596.291 Office equipment

Kendaraan 989.571 - - 989.571 Vehicles

Total biaya perolehan 36.950.931 1.977.999 (121.500) 38.807.430 Total acquisition cost

Akumulasi penyusutan Accumulated depreciation

Renovasi gedung 2.214.949 366.250 - 2.581.199 Leasehold Improvement

Peralatan kantor 19.035.625 4.114.671 (119.813) 23.030.483 Office equipment

Kendaraan 989.571 - - 989.571 Vehicles

Total akumulasi penyusutan 22.240.145 4.480.921 (119.813) 26.601.253 Total accumulated depreciation

Nilai buku 14.710.786 12.206.177 Net book value

31 Desember/December 31, 2021

Saldo awal/ Saldo akhir/

Beginning Penambahan/ Pengurangan/ Ending

balance Additions Disposals *) balance

Biaya perolehan Acquisition cost

Renovasi gedung 3.155.246 43.813 - 3.199.059 Leasehold improvements

Peralatan kantor 21.776.577 10.985.724 - 32.762.301 Office equipment

Kendaraan 989.571 - - 989.571 Vehicles

Total biaya perolehan 25.921.394 11.029.537 - 36.950.931 Total acquisition cost

Akumulasi penyusutan Accumulated depreciation

Renovasi gedung 1.929.386 285.563 - 2.214.949 Leasehold Improvement

Peralatan kantor 16.335.322 2.700.303 - 19.035.625 Office equipment

Kendaraan 989.571 - - 989.571 Vehicles

Total akumulasi penyusutan 19.254.279 2.985.866 - 22.240.145 Total accumulated depreciation

Nilai buku 6.667.115 14.710.786 Net book value

60