Page 296 - AR BRIDS 2022 - EBOOK - FINAL

P. 296

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2022 dan untuk As of December 31, 2022 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

5. PIUTANG TRANSAKSI PERANTARA 5. RECEIVABLE FROM BROKERAGE

PEDAGANG EFEK (lanjutan) TRANSACTIONS OF SECURITIES (continued)

a. Piutang Nasabah (lanjutan) a. Receivables from customers (continued)

Kisaran tingkat suku bunga atas piutang marjin Interest rate ranges on margin receivables from

nasabah masing-masing untuk tahun 2022 dan customers for the year 2022 and 2021 are

2021 adalah masing-masing sebesar 18,00% 18.00% to 13.00%, per annum.

sampai dengan 13,00% per tahun.

Nilai wajar jaminan saham untuk piutang marjin The fair value of shares collateral for margin

nasabah berdasarkan pada harga pasar kuotasi receivables from customers based on quoted

pada tanggal 31 Desember 2022 dan 2021 market prices as of December 31, 2022 and

adalah masing-masing sebesar Rp84.792.344 2021, amounted to Rp84,792,344 and

dan Rp78.206.826. Rp78,206,826, respectively.

Perusahaan melakukan penilaian cadangan The Company assesses allowance for losses

kerugian atas piutang nasabah secara kolektif on receivables from customers collectively and

dan individual. individually.

Perubahan nilai tercatat bruto adalah sebagai Movement in the gross carrying amount are as

berikut: follows:

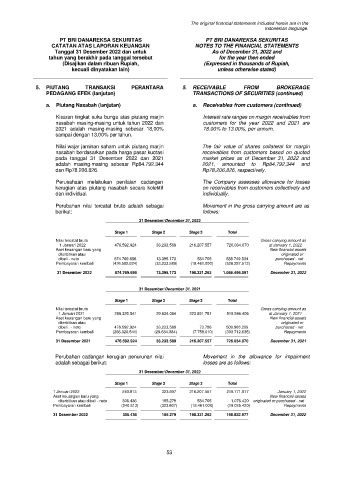

31 Desember/December 31, 2022

Stage 1 Stage 2 Stage 3 Total

Nilai tercatat bruto Gross carrying amount as

1 Januari 2022 476.592.924 33.233.589 216.207.557 726.034.070 at January 1, 2022

Aset keuangan baru yang New financial assets

diterbitkan atau originated or

dibeli - neto 874.769.656 13.395.173 584.705 888.749.534 purchased - net

Pembayaran kembali (476.592.924) (33.233.589) (18.461.000) (528.287.513) Repayments

31 Desember 2022 874.769.656 13.395.173 198.331.262 1.086.496.091 December 31, 2022

31 Desember/December 31, 2021

Stage 1 Stage 2 Stage 3 Total

Nilai tercatat bruto Gross carrying amount as

1 Januari 2021 266.320.541 29.634.084 223.891.781 519.846.406 at January 1, 2021

Aset keuangan baru yang New financial assets

diterbitkan atau originated or

dibeli - neto 476.592.924 33.233.589 73.786 509.900.299 purchased - net

Pembayaran kembali (266.320.541) (29.634.084) (7.758.010) (303.712.635) Repayments

31 Desember 2021 476.592.924 33.233.589 216.207.557 726.034.070 December 31, 2021

Perubahan cadangan kerugian penurunan nilai Movement in the allowance for impairment

adalah sebagai berikut: losses are as follows:

31 Desember/December 31, 2022

Stage 1 Stage 2 Stage 3 Total

1 Januari 2022 240.813 323.607 216.207.557 216.771.977 January 1, 2022

Aset keuangan baru yang New financial assets

diterbitkan atau dibeli - neto 306.436 185.279 584.705 1.076.420 originated or purchased - net

Pembayaran kembali (240.813) (323.607) (18.461.000) (19.025.420) Repayments

31 Desember 2022 306.436 185.279 198.331.262 198.822.977 December 31, 2022

53