Page 14 - AR BRIDS 2022 - EBOOK - FINAL

P. 14

PT BRI DANAREKSA SEKURITAS

Laporan Tahunan Terintegrasi 2022

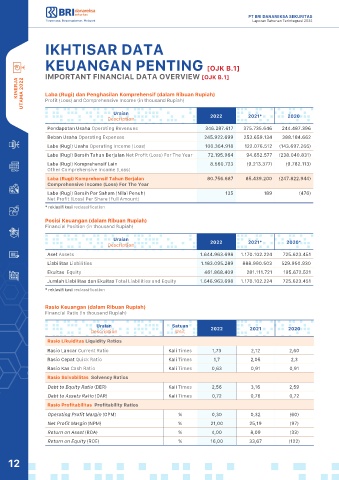

IKHTISAR DATA

KEUANGAN PENTING [OJK B.1]

IMPORTANT FINANCIAL DATA OVERVIEW [OJK B.1]

KINERJA UTAMA 2022 Laba (Rugi) dan Penghasilan Komprehensif (dalam Ribuan Rupiah)

Profit (Loss) and Comprehensive Income (in thousand Rupiah)

Uraian

Description 2022 2021* 2020

Pendapatan Usaha Operating Revenues 346.287.617 375.735.646 244.487.396

Beban Usaha Operating Expenses 245.922.699 253.659.134 388.184.662

Laba (Rugi) Usaha Operating Income (Loss) 100.364.918 122.076.512 (143.697.266)

Laba (Rugi) Bersih Tahun Berjalan Net Profit (Loss) For The Year 72.195.964 94.652.577 (238.040.831)

Laba (Rugi) Komprehensif Lain 8.560.723 (9.213.377) (9.782.113)

Other Comprehensive Income (Loss)

Laba (Rugi) Komprehensif Tahun Berjalan 80.756.687 85.439.200 (247.822.944)

Comprehensive Income (Loss) For The Year

Laba (Rugi) Bersih Per Saham (Nilai Penuh) 135 189 (476)

Net Profit (Loss) Per Share (Full Amount)

* reklasifikasi reclassification

Posisi Keuangan (dalam Ribuan Rupiah)

Financial Position (in thousand Rupiah)

Uraian

Description 2022 2021* 2020*

Aset Assets 1.644.963.698 1.170.102.224 725.623.451

Liabilitas Liabilities 1.183.095.289 888.990.503 529.950.930

Ekuitas Equity 461.868.409 281.111.721 195.672.521

Jumlah Liabilitas dan Ekuitas Total Liabilities and Equity 1.646.963.698 1.170.102.224 725.623.451

* reklasifikasi reclassification

Rasio Keuangan (dalam Ribuan Rupiah)

Financial Ratio (in thousand Rupiah)

Uraian Satuan

Description Unit 2022 2021 2020

Rasio Likuiditas Liquidity Ratios

Rasio Lancar Current Ratio Kali Times 1,73 2,12 2,60

Rasio Cepat Quick Ratio Kali Times 1,7 2,05 2,3

Rasio Kas Cash Ratio Kali Times 0,63 0,91 0,91

Rasio Solvabilitas Solvency Ratios

Debt to Equity Ratio (DER) Kali Times 2,56 3,16 2,59

Debt to Assets Ratio (DAR) Kali Times 0,72 0,76 0,72

Rasio Profitabilitas Profitability Ratios

Operating Profit Margin (OPM) % 0,30 0,32 (60)

Net Profit Margin (NPM) % 21,00 25,19 (97)

Return on Asset (ROA) % 4,00 8,09 (33)

Return on Equity (ROE) % 16,00 33,67 (122)

12