Page 8 - AR BRIDS 2021 - FINAL - HIRES - 2903

P. 8

Performance Glimpse

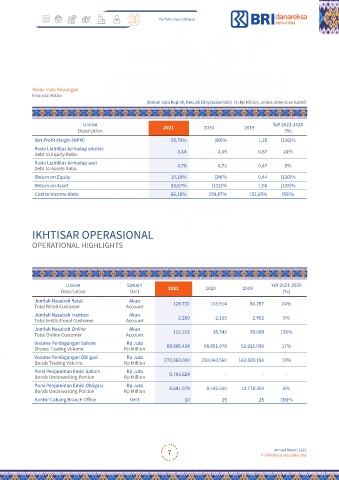

Rasio-rasio Keuangan

Financial Ratios

(Dalam Juta Rupiah, Kecuali Dinyatakan lain) (in Rp Million, unless otherwise stated)

Uraian YoY 2021-2020

Description 2021 2020 2019 (%)

Net Profit Margin (NPM) 25,70% (99)% 1,25 (126)%

Rasio Liabilitas terhadap ekuitas 3,14 2,59 0,87 21%

Debt to Equity Ratio

Rasio Liabilitas terhadap aset 0,76 0,72 0,47 5%

Debt to Assets Ratio

Return on Equity 10,10% (34)% 0,44 (130)%

Return on Asset 33,67% (122)% 1,56 (128)%

Cost to Income Ratio 66,16% 159,87% 152,65% (59)%

IKHTISAR OPERASIONAL

OPERATIONAL HIGHLIGHTS

Uraian Satuan 2021 YoY 2021-2020

Description Unit 2020 2019 (%)

Jumlah Nasabah Retail Akun 128.732 103.914 60.257 24%

Total Retail Customer Account

Jumlah Nasabah Institusi Akun 2.260 2.155 2.962 5%

Total Institutional Customer Account

Jumlah Nasabah Online Akun 112.213 38.742 39.069 190%

Total Online Customer Account

Volume Perdagangan Saham Rp Juta 68.996.434 58.891.078 51.915.095 17%

Shares Trading Volume Rp Million

Volume Perdagangan Obligasi Rp Juta 273.963.000 230.043.560 162.839.180 19%

Bonds Trading Volume Rp Million

Porsi Penjaminan Emisi Saham Rp Juta 9.705.624 - - -

Bonds Underwriting Portion Rp Million

Porsi Penjaminan Emisi Obligasi Rp Juta 8.641.078 8.142.500 12.778.300 6%

Bonds Underwriting Portion Rp Million

Kantor Cabang Branch Office Unit 10 25 25 (36)%

Annual Report 2021

7 PT BRI Danareksa Sekuritas