Page 294 - AR BRIDS 2020 - 1204 - FULL

P. 294

The original financial statements included herein are in the

Indonesian language.

PT BRI DANAREKSA SEKURITAS PT BRI DANAREKSA SEKURITAS

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2020 dan untuk As of December 31, 2020 and

tahun yang berakhir pada tanggal tersebut for the year then ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

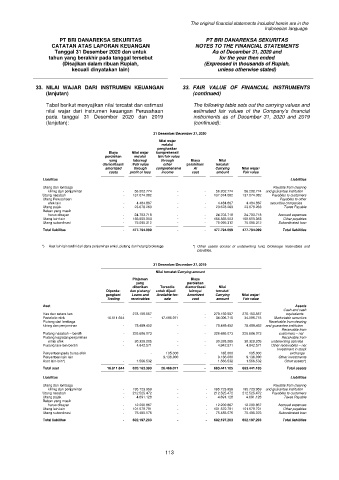

33. NILAI WAJAR DARI INSTRUMEN KEUANGAN 33. FAIR VALUE OF FINANCIAL INSTRUMENTS

(lanjutan) (continued)

Tabel berikut menyajikan nilai tercatat dan estimasi The following table sets out the carrying values and

nilai wajar dari instrumen keuangan Perusahaan estimated fair values of the Company’s financial

pada tanggal 31 Desember 2020 dan 2019 instruments as of December 31, 2020 and 2019

(lanjutan): (continued):

31 Desember/December 31, 2020

Nilai wajar

melalui

penghasilan

Biaya Nilai wajar komprehensif

perolehan melalui lain/fair value

yang laba/rugi through Biaya Nilai

diamortisasi/ /Fair value other perolehan/ tercatat/

amortized through comprehensive At Carrying Nilai wajar/

costs profit or loss income cost amount Fair value

Liabilitas Liabilities

Utang dari lembaga Payable from clearing

kliring dan penjaminan - 56.202.774 - - 56.202.774 56.202.774 and guarantee institution

Utang nasabah - 137.074.082 - - 137.074.082 137.074.082 Payables to customers

Utang Perusahaan Payables to other

efek lain - 4.484.867 - - 4.484.867 4.484.867 securities companies

Utang pajak - 23.678.263 - - 23.678.263 23.678.263 Taxes Payable

Beban yang masih

harus dibayar - 24.703.718 - - 24.703.718 24.703.718 Accrued expenses

Utang lain-lain - 156.555.083 - - 156.555.083 156.555.083 Other payables

Utang subordinasi - 75.095.312 - - 75.095.312 75.095.312 Subordinated loan

Total liabilitas - 477.794.099 - - 477.794.099 477.794.099 Total liabilities

*) Aset lain-lain terdiri dari dana penjaminan emisi, piutang dan hutang brokerage *) Other assets consist of underwriting fund, brokerage receivables and

payables.

31 Desember/December 31, 2019

Nilai tercatat/Carrying amount

Pinjaman Biaya

yang perolehan

diberikan Tersedia diamortisasi Nilai

Diperda- dan piutang/ untuk dijual/ lainnya/ tercatat/

gangkan/ Loans and Available-for- Amortized Carrying Nilai wajar/

Trading receivables sale cost amount Fair value

Aset Assets

Cash and cash

Kas dan setara kas - 278.150.557 - - 278.150.557 278.150.557 equivalents

Portofolio efek 16.811.644 - 17.195.071 - 34.006.715 34.006.715 Marketable securities

Piutang dari lembaga Receivable from clearing

kliring dan penjaminan - 78.489.452 - - 78.489.452 78.489.452 and guarantee institution

Receivable from

Piutang nasabah – bersih - 226.686.073 - - 226.686.073 226.686.073 customers – net

Piutang kegiatan penjaminan Receivable from

emisi efek - 30.328.205 - - 30.328.205 30.328.205 underwriting activites

Piutang lain-lain-bersih - 4.942.571 - - 4.942.571 4.942.571 Other receivables – net

Investment in stock

Penyertaan pada bursa efek - 135.000 - 135.000 135.000 exchange

Penyertaan lain-lain 9.136.000 - 9.136.000 9.136.000 Other investments

Aset lain-lain*) - 1.566.532 1.566.532 1.566.532 Other assets*)

Total aset 16.811.644 620.163.390 26.466.071 - 663.441.105 663.441.105 Total assets

Liabilitas Liabilities

Utang dari lembaga Payable from clearing

kliring dan penjaminan - 195.723.959 - - 195.723.959 195.723.959 and guarantee institution

Utang nasabah - 212.525.472 - - 212.525.472 212.525.472 Payables to customers

Utang pajak - 4.691.128 - - 4.691.128 4.691.128 Taxes Payable

Beban yang masih

harus dibayar - 12.200.867 - - 12.200.867 12.200.867 Accrued expenses

Utang lain-lain - 101.570.701 - - 101.570.701 101.570.701 Other payables

Utang subordinasi - 75.485.076 - - 75.485.076 75.485.076 Subordinated loan

Total liabilitas - 602.197.203 - - 602.197.203 602.197.203 Total liabilities

113